Sankyo Ltd - The best bet on a pachinko revival

Sankyo is a Japanese gaming machine maker that trades at 1.6x EV/EBITDA and has bought back a third of its shares since 2019.

Image Source: Wikimedia Commons

Summary

Sankyo is a Tokyo-listed maker of Japanese gaming machines with a market cap of around $2.6 bn. It trades at just 1.5x forward EV/EBITDA and has 70% of its market cap in cash and short-term investments.

The company has been consistently profitable, generating positive free cash flow in each of the past 20 years — even through the global financial crisis and recent pandemic. Return on equity stands at around 18% and is on the rise.

Sankyo is very shareholder-friendly. The company has bought back almost one third of its shares since 2019 and pays a 2.3% dividend. Management has promised further share buybacks and a potential rise in the dividend over time.

Sankyo has a strong brand thanks to a history of successful tie-ins and licensing deals with anime series such as “Neon Genesis Evangelion.” It recently regained the top market share in “pachinko” machines sales.

Why does the opportunity exist? Japanese stocks are cheap. Japan’s pachinko gaming industry has been shrinking for 25 years and was hit hard by the pandemic. And Sankyo serves the ESG-unfriendly gambling industry.

Forecasts for the death of pachinko look premature. Sales of new “smart machines” with improved gaming performance show signs of reinvigorating the industry. And the recent lifting of a TV advertising ban has helped boost sales.

There is no shortage of cheap companies in Japan. More than half of the companies listed on the Tokyo Stock Exchange (TSE) still trade below their book value. Many fall in the even cheaper “net-net” bucket of trading below their net current asset value (NCAV). Other investors such as Altay Capital have done an excellent job at detailing opportunities in this space. Net-nets are often cheap for a reason. Some are classic “value traps” with poor growth prospects, mediocre returns on equity, and geriatric management teams that hoard cash and refuse to return it to shareholders. The TSE has been urging companies to raise their ROE to unlock greater value. Partly as a result, the Japanese stock market is now trading at the highest level in 33 years.

Is the opportunity over? No. Many stocks have simply gone from ludicrous cheap to silly cheap. That brings us to Sankyo Ltd, a $2.5 billion company that is basically unheard of outside of Japan. I am yet to come across a writeup or any meaningful discussion in English on the stock. To be clear, this is not the most attractive stock in my portfolio, or even the most attractive Japanese one. And it is no longer in pure bargain territory — trading at 1.2 times its book value after rising more than 50% in the last year. That said, Sankyo is still very cheap, has strong earnings momentum, and most importantly, a quality management team intent on rewarding shareholders. As such I am happy to hold it as part of a diversified basket of Japanese stocks.

Sankyo is also part of a fascinating industry that receives next to no coverage outside of Japan. I couldn’t resist digging in further.

What does Sankyo do?

Sankyo is a pretty simple business. It makes and sells gaming machines for the Japanese domestic market. Sankyo has been around since 1966, when the company was established in Nagoya City. Being a Japanese company, Sankyo also operates an obligatory golf club on the side, but this is tiny and immaterial to the analysis so will be ignored below. Sankyo’s revenues primarily fall into three buckets:

Manufacture and sales of pachinko machines (78% of total revenues)

Manufacture and sales of pachislot machines (14% of total revenues)

Recurring sales of replacement steel balls, etc (8% of total revenues)

Pachinko, in its original form, is a mechanical arcade game that is somewhat akin to pinball. More recent machines are a hybrid of old and new; retaining the mechanical component (like a vertical pinball machine with steel balls and spring-loaded handles) but adding bells and whistles and an electronic interactive component. It is a quasi legal form of gambling in Japan, where cash winnings are not allowed. The loophole? Pachinko balls can be traded at pachinko parlors for “special prize” tokens. Those tokens can then (legally) be sold off premises for cash.

If this sounds somewhat shady, it is; the pachinko industry has long been notorious for its links to money laundering and organized crime in Japan. That said, the industry has been around since the pre-war period, and has recently been cleaned up with tighter regulations that address gambling addiction. At its height in the mid-1990s, the Japanese pachinko market reportedly generated more gambling revenue than Las Vegas, Macau and Singapore combined. Even today, there are roughly three times as many pachinko parlors in Japan as there are McDonalds franchises.

Most pachinko parlors also feature “pachislot” machines, which are more akin to the traditional slot machines found in western casinos, featuring interactive screens and a lot of loud music and flashing lights.

Sankyo expects to sell around 290,000 pachinko machines this fiscal year, with an average unit price of around US$3,150. Much of the installed base of machines has been replaced in recent years due to tighter gaming regulations that came into force in Feb 2022. This replacement cycle has acted as a catalyst for innovation in the sector. Sankyo has been refreshing its brand with tie-ins featuring leading anime characters. Its “Neon Genesis Evangelion” themed machines (see below) have been a particularly big hit, along with “Mobile Suit Gundam” and other anime. In addition, industry-wide sales appear to be enjoying a revival on the back of a new wave of “smart pachinko” and “smart pachislot” machines that offer an improved gaming experience and lower operating costs for the owners of pachinko parlors, since the machines offer no physical payout of medals or balls.

Sankyo was a solid business for decades, but one that didn’t generate a whole lot of value for shareholders. It’s book value has been mostly flat, until a shareholder-friendly pivot by management in 2019 led to aggressive share buybacks that have helped push up book value per share, as the chart below shows. See the “capital allocation” section below for more.

Financials

Sankyo’s business is pretty resilient. It has generated positive free cash flow every year for the past two decades. At the height of the pandemic, pachinko parlors were forced to shut down and the company’s revenues collapsed 26% in 2020/21. The company still generated $76 mn in free cash flow, a 5% yield on equity.

Sankyo posted a huge increase in profits in the year through March, as the chart below shows. Management attributes this to increasing “brand power” and a corresponding rise in market share. But the industry as a whole appears to be enjoying a mini resurgence on the back of new product releases. Greater availability of semiconductors and other electronic components — shortages had held back production of game machines in recent years — has also helped.

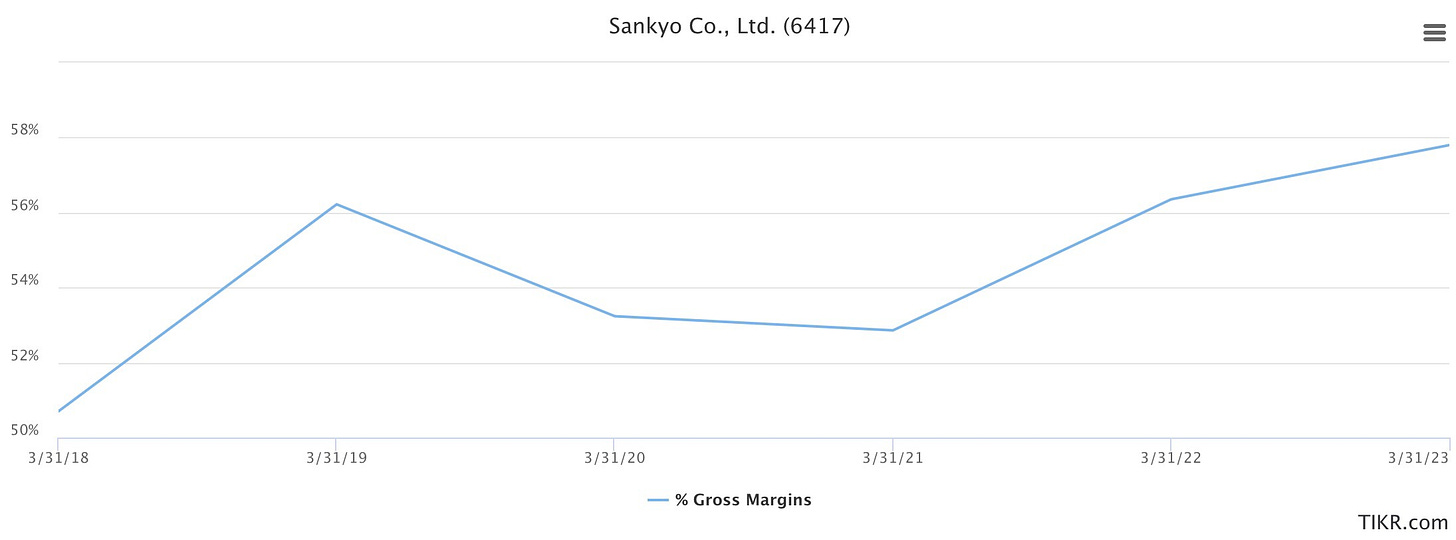

The surge in revenues has led to a further rise in gross margins as operational leverage kicks in. But Sankyo’s margins have been on the rise for several years now, partly a result of cost cutting measures such as increasing the number of common parts across machines and the ability to recycle them (retired pachinko machines are typically sent back to manufacturers for reuse and recycling). See below. Sankyo’s return on equity has risen to around 18% after climbing steadily for a few years.

The big question is whether these positive fundamentals have any momentum. Sankyo is guiding for a further 11% rise in revenues this fiscal year, with modestly lower net profit. And there are buds of optimism across the industry. Among the reasons why:

New-generation ‘smart” pachinko and pachislot machines — increasingly interactive with licensed character tie-ins and links to popular anime — appear to be reinvigorating the industry and broadening its appeal (historically men make up around 80% of pachinko players, with the bulk aged 40 and above).

A ban on TV ads for pachinko parlors was recently lifted for the first time in over a decade (in a bid to reinvigorate the industry after it was hit hard by covid). Sankyo rival Sega Sammy Corp said in its latest earnings call this was helping boost sales.

Smart pachislot machines, first introduced in November 2022, have already captured around 15% of the market, according to Sega Sammy. Sankyo, which is traditionally a bit weaker in the “pachislot” category, logged a 154% rise in pachislot machine sales in its latest fiscal year. Momentum remains very strong in this category, and is likely to be repeated in the larger pachinko segment as hit titles incentivize pachinko parlors to refresh their lineups. The installation rate of smart pachinko machines, launched in April this year, still stands at around 3%, leaving huge upside sales potential should a replacement cycle kick in.

A dying industry?

Let’s confront the bear case head on. The pachinko industry has been shrinking for decades, as the chart below shows.

A decline in the number of pachinko halls has been partly offset by industry consolidation and the rise of large-scale gaming establishments. But there is no getting around the fact that the total number of customers is also slowly declining (as is Japan’s population). Many pachinko parlors are cash strapped, with limited capacity to update their installed machines to the latest variants.

Also looming: the legalization of casinos in Japan, with the first resort set to open in Osaka in 2029. Casino licenses will be hard to come by, and these establishments look set to target primarily wealthy individuals and high net worth Asian gamblers — a different segment to that served by pachinko or pachislot players. Japanese citizens will also be subject to strict regulation and entry requirements at any new casinos. Loans will be primarily restricted to foreign citizens, for example.

That said, casinos would clearly provide some competition for lower-end gambling options such as pachinko, and could accelerate the industry’s decline.

That doesn’t necessarily spell doom for companies such as Sankyo, however, as other sunsetting industries such as tobacco and coal show. These hated industries often feature dynamics such as: little to no competition from new entrants; limited growth capex needs; strong free cash flow; and strong returns, as long as management doesn’t do dumb things with the cash. In other words, there’s nothing wrong with a slowly melting ice cube.

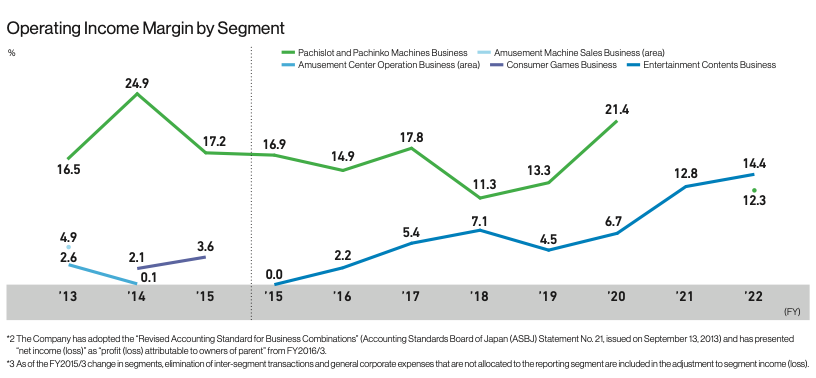

Indeed, Sega Sammy appears to view its pachinko and pachislot business (smaller brother to its much larger entertainment and gaming franchise) as somewhat of a cash cow, describing it as a “platform for generating stable cash going forward.” The business has historically enjoyed much higher operating margins than Sega Sammy’s “crown jewel” segment that includes valuable IP like Sonic the Hedgehog. See below.

Capital allocation

Sankyo is shareholder-friendly, and unusually so for a Japanese company. It has been voraciously gobbling up its own shares since 2019, shrinking the share count by more than 30% over this period, as the chart below shows.

Sankyo also pays a modest dividend (2.3%). Management says it aims to raise the dividend over time, and continue its opportunistic share buybacks. Given the company’s uber conservative balance sheet (70% of market cap in cash and short-term investments) and strong FCF profile, there is room for the company to get even more aggressive on this front. Like many Japanese companies, Sankyo could easily retire half of its free float overnight if it so wished.

Sankyo does not have clear metrics in place for capital returns, but language like the following is prominent in its annual reports.

“The company regards the return of profits to shareholders as one of its most important management priorities”

Capex needs are limited, with plenty of capacity at the company’s production facility in Isesaki City, Gunma Prefecture. In summary, I don’t see any reason to expect a change in the company’s inclination to aggressively return capital to shareholders.

Management

The company is led by CEO Akihiko Ishihara, a Sankyo veteran who took over the role in June 2022 from Hideyuki Busujima, the son of Sankyo’s founder. Busujima is a billionaire businessmen and still serves as chairman of Sankyo’s board of directors. He holds around 5.8% of the shares outstanding in the company, with his two sisters owning a similar amount collectively.

Competitors

The pachinko machine business has undergone quite a bit of consolidation in the past decade — and several of the leading players such as Sanyo Bussan are not public companies. Sankyo has typically been in the top tier of players, and its market share has been on the rise since 2021, as the chart below shows. They have now regained the number one spot by market share, according to the company.

Do they have a moat? Let’s not kid ourselves. It’s a pretty competitive business. That said, Sankyo seems to be doing something right. It has a decades-long history of coming up with hit products — and regularly refreshing its lineup to stay current. In 2018 and 2022, for example, Sankyo won the “Pachinko Grand Prize” for the most popular machine chosen by gamers in Japan, most recently for “Fever Mobile Suit Gundam Unicorn.”

It’s also worth noting that given perceptions of pachinko as a sunsetting industry, we’re unlikely to see new domestic entrants. Global companies have never bothered with the sector, which is uniquely Japanese1 and is too niche to move the dial.

(Note: I started writing quick thoughts on a handful of Sankyo’s publicly traded competitors — including Sega Sammy (6460.T), Fujishoji (6257.T), Universal Entertainment (6425.T) and Daikoku Denki (6430.T), but it got too lengthy and is probably of interest to otaku only. I will post this in a separate follow-up).

Valuation

Here are some key valuation metrics for Sankyo Ltd, courtesy of Tikr:

Trailing P/E: 7.18x

Trailing P/BV: 1.18x

Forward EV/EBITDA: 1.54x

Forward MC/FCF: 7.30x

To be sure, this doesn’t screen as crazy cheap for a Japanese company. But it does seem too cheap compared to competitors with similar returns on equity (Sega Sammy — albeit with a more diversified business — trades at 15x FCF, for example, while Daikoku Denki trades at twice the earnings multiple of Sankyo). Tell me if I’m missing something, but this valuation discount doesn’t seem warranted.

Precisely how much is Sankyo worth? I really don’t know. I’m not going to do a fancy DCF or detailed analysis here, because I think it suffices to say that: Sankyo is a cheap stock with inflecting earnings in an industry dragged down by excess pessimism. It has a competent management team with a long history of generating hit products, that is also intent on returning excess capital to shareholders.

As such, I am happy to hold a small position in Sankyo as part of a diversified basket of Japanese stocks with similar characteristics.2 As Charlie Munger once said, “if you see a fat man walking down the street, you don't need to weigh him to know that he's fat.”

Conclusion

I think Sankyo is a good way to play a revival in Japan’s long stagnant pachinko and pachislot industry. There is likely a lot of upside in the stock if a “smart pachinko” replacement cycle kicks off. Even if the current rebound in sales runs out of gas, I do not expect the industry to fall off a cliff any time soon. In the meantime, I see limited downside risk: Sankyo has a rock-solid balance sheet, and it should carry on generating plenty of cashflow and returning it to shareholders.

Disclosure: I own shares in Sankyo Ltd. This post is for informational purposes only. Nothing in this blog should be construed as financial advice or a recommendation to buy or sell any security. Gamble responsibly. Do your own due diligence.

In my near decade of living in Japan in the early 2000s, I’m not sure I ever felt more out of sorts than the couple of times I stumbled into a pachinko parlor. The cacophonous noise. The flashing lights. And the stares. I clearly didn’t look like I knew what I was doing.

I have around 10% of my portfolio in Japanese stocks, primarily net-nets. I will likely be increasing the size of this basket over time.

Good read! I agree with your sentiment that it's cheap and that you don't need to do a DCF. If you have to do a DCF to figure out if it's cheap or not, it's not.

I'm totally ignorant on this space and generally bearish on casinos/gambling (at least in the U.S), but Sankyo is obviously cheap. Is Pachislot taking share from traditional Pachinko and can they compete there as well? Even if earnings do decline from here and that's not a given, it's interesting.

Management forecasts increasing revenue next year +11% which is a positive. Op income set to increase +1.7% too.

This is a bit larger market cap than most of my JP basket, but I love the buybacks. Will likely take a small position here as well.

Idk about you but I don’t like a company that is buying its own stock while it’s declining. Buying its own stock is equivalent to believing in the long-term future of the business.